Recently we received a letter box drop from "the powers that be" who control the road works on Stafford Road. It told us that three shops on Stafford Road were trading "as usual".

Here's one of the shops - Midway:

The photo shows that Midway General Store is cut off completely from its feeder roads - Stafford Road and Gordon Street.

It may be that Midway's trading hours are the same as they always have been - but to suggest that they are trading "as usual" has been met with derision in the neighbourhood. Midway Store looks more like something set in a war zone or the makings of a detention camp than a "as usual" trading store.

This public relations attempt has simply backfired - an unintended consequence.

Then, to make matters worse, two other stores on Stafford Road were mentioned: the Fish and Chip Shop and the Dental Technician.

They were located on the circularised map as lying between Gordon Street and Khartoum Street.

This is a photo of the location identified on the map:

No Fish'n'Chips Shop, No Dental Technician.

Were they miraculously moved? No. They are located, and always have been, in the next block west between Khartoum Street and Richmond Street:

In my opinion, the "powers that be" in charge of the road works on Stafford Road are taking on, more and more, the appearance of characters from Fawlty Towers.

If this wasn't so serious it would be funny. But it's not funny. It is derisory.

Meanwhile, the tranquil streets of Gordon Park continue with the unfortunate, and potentially deadly, traffic flows which have increased since the work began on Stafford Road.

Redbacka

(Lance Blundell)

Redback's Australian Stock Market Report

A daily report on the Australian Stock market and selected Australian stocks.

Monday, July 11, 2011

Friday, May 13, 2011

INTOLERABLE

This week the problems with blogger have been intolerable. At times I've been able to upload images but no text. Then ... I was unable to upload anything at all.

I've moved the blog to:

http://redbackmarketreport.wordpress.com

I have no idea how reliable Wordpress blogger is - but it can't be worse than I've experienced this week. :)

The blog I've set up on Wordpress is still a bare bones affair - but I hope to get around to dressing it up this week end.

In the meantime, the daily Morning Coffee for Saturday is up. Content is the key for a blog like this - and the usual informative analysis is provided today.

Good luck

Red

I've moved the blog to:

http://redbackmarketreport.wordpress.com

I have no idea how reliable Wordpress blogger is - but it can't be worse than I've experienced this week. :)

The blog I've set up on Wordpress is still a bare bones affair - but I hope to get around to dressing it up this week end.

In the meantime, the daily Morning Coffee for Saturday is up. Content is the key for a blog like this - and the usual informative analysis is provided today.

Good luck

Red

Thursday, May 12, 2011

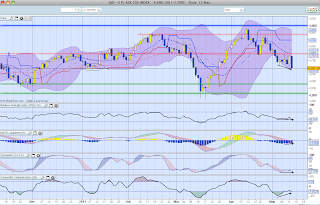

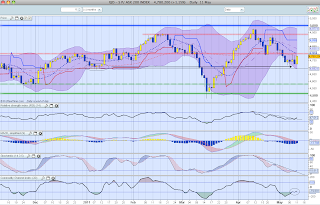

Postprandials, Thursday 12/5/2011

That last candle looks UGLY. So ... a frog about to be kissed by a princess is ugly. :)

Let's take a look at the stats:

- XJO (ASX200) -1.8%

- XTL (Twenty Leaders) -1.8%

- XFL (Fifty Leaders) -1.8%

- XFJ (Financials) -1.5%

- XMJ (Materials) -2.6%

- XSO (Small Ordinaries) -1.8%

The best performing Sector today was Telecoms -0.2%.

Technical Comment on the ASX200 Market:

Volume today was well above average - in excess of 1.5billion shares traded for the All Ordinaries. That's the heaviest since late March. Panic selling? Maybe. But in the middle of March we saw a series of days higher than that and two days in excess of 2billion. So, today was bad. But we might be looking at worse.

Technical Comment on the ASX200 Market:

- The Index is below 50-Day MA and the 13-Day MA. Negative.

- Indicators:

- Slow Stochastic 12.6. It continues in the Oversold region

- The 13-Day MA is above the 50-Day MA. Positive

- RSI 38.9. In the Caution zone if you are short.

- MACD Histogram below Zero. Negative.

- MACD below the Zero line. Negative

- CCI -110.8 . Back below -100. Look for a rise above -100 for a buy signal.

Positive divergences are beginning to appear between the indicators and the index chart. These mean zilch until a hook up starts to occur. But it is promising.

Final opinion: we're not far off a medium term bottom.

Good luck

Red

Wednesday, May 11, 2011

Morning Coffee, Thursday 12/5/2011

In America:

- Dow Industrials -1.02%

- Dow Transports -1.27%

- SP500 -1.11%

- Russell 2000 -1.78%

- Nasdaq100 -1.76%

Comment: Ouch. That hurt.

The Materials Sector -2.66% and Energy Sector -2.89%. That's an even bigger OUCH - and a big minus for Australia. The Banking Sector was down -0.98%. Semi-conductors was down -0.83%.

Europe:

- France +0.14%

- Germany -0.09%

- London -0.71%

EWA (Australian Shares ETF traded on the New York Stock Exchange) -1.98%, The Australian Dollar was down -1.33% to finish at 106.94 - that's another big ouch. A strong Ozzie Dollar is needed to maintain the liquidity for a strong stock market. Gold in Oz Dollars was up +0.33% in the past 24 hours. That compares with a fall of over -1% in the price of Gold in U.S. Dollars.

Technical Comment on the SP500:

- The SP500 finished at 1342.08. Well above the support of the recent low at 1330.

- The Index is back below the 13-Day MA (negative) .

- Above the 50-Day MA (positive).

- Indicators:

- Slow Stochastic 56.2. Falling. Negative. (It looks like it needs to get to below 20 before a rebound can take place.)

- The 13-Day MA is above the 50-Day MA. Positive

- RSI now 52.3 and falling. Headed for the 40 area?

- MACD Histogram below Zero. Negative.

- CCI +26.3 and falling. Negative.

And the price of oil was slammed last night (-4.57%) - now back below for West Texas. (Yesterday I said: This looks to me like a pause before a drop back below 100.)

The action in America last night was even more negative than the night before. Support at 1329 beckons.

This will knock the nascent rally from yesterday in Australia. I doubt the "buy the dips" crowd can save it today. But, in the short term, I still don't think there's a lot of downside for Australia. In the medium term, I'm sticking to my mantra "sell the rallies" until I see good evidence to change the chant.

Good luck

Red

Postprandials, Wednesday 11/5/2011

Today the XJO (ASX200 - chart above) finished up 1.2%. Volume was solid without being spectacular. That's good - very high volume on a big up day often conceals selling by the "smart money".

Other major indices today:

- XTL (Twenty Leaders) +1%

- XFL (Fifty Leaders) +1% XFJ (Financials) +0.6%

- XMJ (Materials) +1.9%

- XSO (Small Ordinaries) +1.6%

The best performing Sectors today were Materials +1.9%, Info.Tech. +1.8%, Energy +1.7%.

Technical Comment on the ASX200 Market:

- The Index is below 50-Day MA and the 13-Day MA. Negative.

- Indicators:

- Slow Stochastic 18.8 and rising above its signal line. Positive.

- The 13-Day MA is above the 50-Day MA. Positive RSI 47 and rising. It has broken above its down trend line from early April. Positive.

- MACD Histogram below Zero. Negative. but rising.

- MACD below the Zero line. Negative

- CCI -79.7 and rising. It has broken above -100 for a buy signal.

In the 50-Leaders the ratio for Advancers and Decliners was 5.1:1 - very bullish. The A/D Ratio for the general market was 1.5:1 - positive but not especially so. I'd prefer to see the A/D line for the general market better than that on a strong day. The Small Ordinaries (top chart), in the short term, continues to outperform the XJO. That's a positive.

Today's performance was good. The market now needs to confirm with some follow-through buying.

Formidable resistance lies overhead.

Tuesday, May 10, 2011

Morning Coffee, Wednesday 11/5/2011

In America:

- Dow Industrials +0.6%

- Dow Transports +1.05%

- SP500 +0.81%

- Russell 2000 +1.56%

- Nasdaq100 +0.85%

Comment: The SP500 has now been up three days in a row. The market today was generally strong with excellent breadth in the Small Caps (Russell 2000).

The Materials Sector +0.85% and Energy Sector +0.47% were both up. That's something of a plus for Australia. The Banking Sector was up +0.93%. Semi-conductors was solid +0.5%.

Europe:

- France +1.13%

- Germany 1.23%

- London +1.28%

EWA (Australian Shares ETF traded on the New York Stock Exchange) +0.51%, The Australian Dollar was up 0.37% to finish at 108.42 - still below the dizzy heights of the 110 region but bouncing back strongly. A strong Ozzie Dollar is needed to maintain the liquidity for a strong stock market. Gold in Oz Dollars was relatively flat -0.19% in the past 24 hours. That compares with a rise of about 0.2% in the price of Gold in U.S. Dollars.

Technical Comment on the SP500:

- The SP500 finished at 1357.16. In a support zone but just above a good support zone.

- The Index is above the 13-Day MA (positive) .

- Above the 50-Day MA (positive).

- Indicators:

- Slow Stochastic 65.. At its signal line and rising. Positive.

- The 13-Day MA is above the 50-Day MA. Positive

- RSI now 60.7 and rising. It's just sneaking into the caution zone (60-70).

- MACD Histogram marginally above Zero. Neutral. But rising.

- CCI +75.4 and rising. Positive.

- The SP500 is in an uprising channel. Positive

And the price of oil rose last nigh (+1.15%) - now at 103.93 for West Texas. This looks to me like a pause before a drop back below 100. Geopolitical events could easily change that outlook.

The action in America last night was positive from the bullish point of view. Major resistance of the recent high 1365 looms ahead. A break above there should see the index head up to the top of the channel.

I've been saying since the weekend before last that the Ozzie market would probably be a case of "sell the rumour, buy the fact". The fact being the budget. Today looks like a "buy" day to me.

Good luck

Red

A big problem

Hello,

I've just noticed that the charts I posted earlier today, although dated 10 May, are, in fact from 9 May.

Big big difference.

Somehow, the software package that I use (ProRealTime) hasn't updated the chart for today although the chart's date has been updated.

The analysis on the blog today is, therefore, relevant for yesterday, but not today. :( :( :(

I'm still waiting for an up to date chart from ProRealTime. That compounded with my problems with Google over the past two days makes me both embarrassed and annoyed - with the internet providers and myself for not noticing.

My apologies if I have misled anyone.

Good luck

Red

I've just noticed that the charts I posted earlier today, although dated 10 May, are, in fact from 9 May.

Big big difference.

Somehow, the software package that I use (ProRealTime) hasn't updated the chart for today although the chart's date has been updated.

The analysis on the blog today is, therefore, relevant for yesterday, but not today. :( :( :(

I'm still waiting for an up to date chart from ProRealTime. That compounded with my problems with Google over the past two days makes me both embarrassed and annoyed - with the internet providers and myself for not noticing.

My apologies if I have misled anyone.

Good luck

Red

Subscribe to:

Posts (Atom)